Figure 14-10.

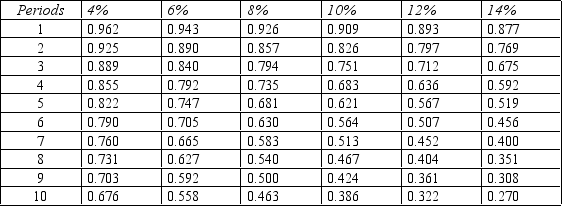

Present value of $1

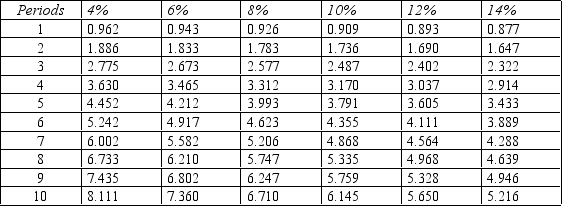

Present value of an Annuity of $1

Present value of an Annuity of $1

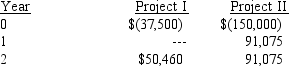

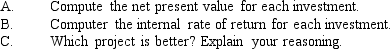

-Refer to Figure 14-10. A company is considering two modifications to its current manufacturing process. The after-tax cash flows associated with the two investments are:

The company's cost of capital is 12%.

The company's cost of capital is 12%.

Definitions:

Accelerated Cost Recovery

A method of depreciation used for tax purposes that allows for higher deductions in the early years of an asset's life.

Straight-Line Depreciation

Straight-Line Depreciation is a method where the cost of a tangible asset is reduced evenly over its useful life.

Deferred Tax Income Tax

A tax liability or asset that arises due to temporary differences between the financial reporting and tax bases of assets and liabilities.

Valuation Allowance

An accounting practice used to offset a deferred tax asset on the balance sheet if it is likely that some portion or all of the asset may not be realized.

Q46: The _ measures the aggregate effect of

Q47: Which of the following relationships is valid

Q52: The standard quantity of materials allowed can

Q62: Gina Production Company uses a standard costing

Q69: The benefits of operational control under a

Q91: The Prince Company reported net income of

Q118: The dollar difference between operating income and

Q163: This is the standard plus the allowable

Q175: The Laurel Company reported the following data

Q179: Actual Costs