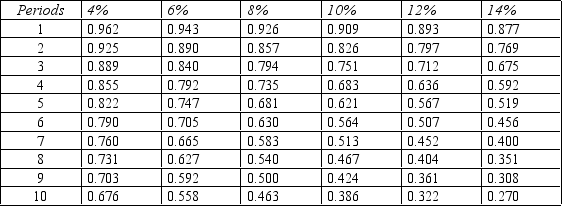

Figure 14-10.

Present value of $1

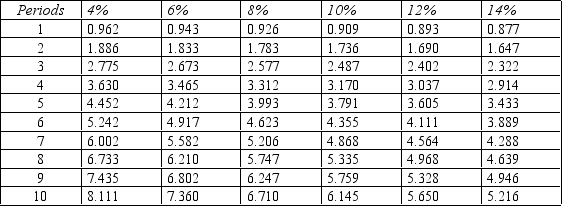

Present value of an Annuity of $1

Present value of an Annuity of $1

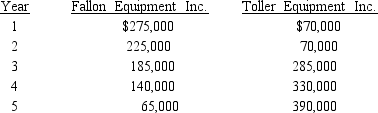

-Refer to Figure 14-10. Ray Corporation is looking to invest in a new piece of equipment. Two manufacturers of this type of equipment are being considered. After-tax inflows for the two competing projects are:

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Required:

A. Assuming a discount rate of 8%, compute the net present value of each piece of equipment.

B. A third option is now available for a supplier outside of the country. The cost is also $400,000, but it will produce even cash flows over its 5-year life. What must the annual cash flow be for this equipment to be selected over the other two? Assume an 8% discount rate.

Definitions:

Marketing Channels

The set of intermediaries or pathways through which goods and services are distributed from producers to consumers.

Consumer Product

Goods produced and intended for use by consumers for personal, family, or household purposes.

Marketing Channel

The pathways through which goods and services flow from producers to consumers, including intermediaries such as wholesalers and retailers.

Types

Distinct and identifiable classes or categories into which things or concepts can be grouped based on shared characteristics or qualities.

Q1: Which of the following is true of

Q82: The indirect method and the direct method

Q99: Standard cost systems are adopted<br>A) to improve

Q102: Which model is better for independent projects

Q105: The formula for the variable overhead spending

Q125: Cooper Industries is considering a project that

Q127: The current assets of Caitlin Company are

Q134: The Grand Department Store had net credit

Q136: If an asset is sold at a

Q174: The amount for "net cash from operating