Figure 14-10.

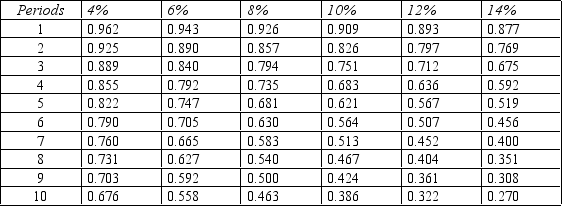

Present value of $1

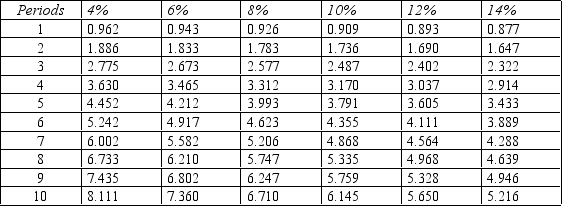

Present value of an Annuity of $1

Present value of an Annuity of $1

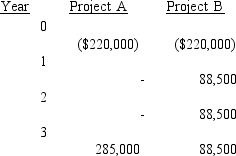

-Refer to Figure 14-10. Durrel Company is considering two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments are as follows:

Durrel's cost of capital is 6%.

Durrel's cost of capital is 6%.

Required:

A. Compute the NPV for each investment and state which project should be chosen based on the NPV.

B. Compute the IRR for each investment and state which project should be chosen based on the IRR.

Definitions:

Lifetime Learning Credits

A tax credit available to taxpayers to offset college and education expenses, aimed at promoting lifelong learning.

Married Filing Separately

A tax filing status for married couples who choose to record their respective incomes, exemptions, and deductions on separate tax returns.

American Opportunity Tax

A credit that helps with the first four years of post-secondary education expenses, offering benefits for tuition, books, and other supplies.

Eligible Student

A student who meets certain criteria, often related to enrollment status and academic progress, to qualify for financial aid or tax benefits.

Q7: Favor Company budgeted the following amounts:<br> <img

Q12: Unlike ROI, residual income does not encourage

Q15: Financing activities involve<br>A) purchasing patent.<br>B) receipt of

Q23: Best Wishes Company had the following information

Q57: Refer to Figure 11-4. Calculate the fixed

Q65: Use the following information to perform the

Q71: Fixed overhead was budgeted at $84,000 and

Q119: Budgeted costs change because total variable costs

Q123: The net income reported on the income

Q129: Crawford Company's standard fixed overhead cost is