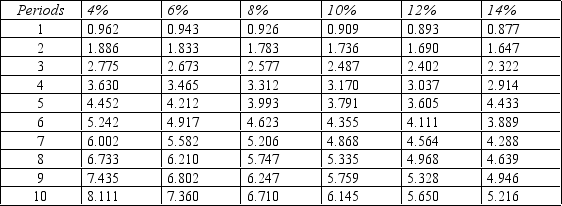

Figure 14-11.

Present value of an Annuity of $1 in Arrears

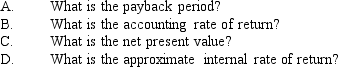

-Refer to Figure 14-11. Aragon Company is considering an investment in equipment that will have an initial cost of $560,290 and yield annual net cash inflows of $90,000. Yearly depreciation will be $56,000. The equipment is expected to be useful for 10 years and then it will be scrapped. Aragon requires a minimum rate of return of 10%.

Definitions:

Compounded Semiannually

Refers to the process of calculating and adding interest to the principal balance of an investment or loan twice a year.

Strip Bond

A fixed-income security derived from the separation of the coupons from the principal of a bond, which are then sold separately as zero-coupon bonds.

Compounded Semiannually

A method of calculating interest where the accrued interest is added to the principal sum and interest is then calculated on the new total twice a year.

Monthly Compounded

Interest calculation in which the interest is added to the principal balance monthly, allowing earnings to increase at a faster rate compared to annual compounding.

Q30: The following transactions occurred last year at

Q31: assumes that all future cash inflows earn

Q64: Last year Neil Company had a net

Q119: The process value chain consists of<br>A) value,

Q120: Which balance sheet accounts are affected by

Q120: A measure viewed by many investors as

Q140: Which of the following formulas would be

Q142: Refer to Figure 11-3. Calculate the variance

Q159: A(n) _ is a responsibility center in

Q172: Which one of the following is not