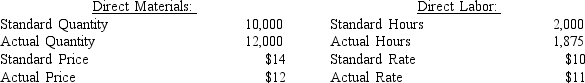

Eastminster Company has the following information:

Definitions:

Activity-Based Costing

A costing method that assigns overhead and indirect costs to related products and services based on the activities that drive costs.

Overhead Applied

The portion of overhead costs allocated to individual products or job orders based on a predetermined rate or method.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific products or projects based on their use of activities, providing more accurate cost information.

Total Overhead Applied

The total amount of indirect manufacturing costs allocated to units of product based on a predetermined rate.

Q5: If actual fixed overhead was $98,400 and

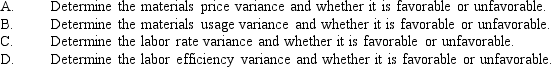

Q18: Refer to Figure 12-7. Calculate the following:<br>

Q20: Stratford Company inspects every steam iron it

Q89: Absorption costing treats fixed factory overhead as

Q98: Refer to Figure 8-2. What is the

Q100: Which of the following is not true

Q129: _ consists of beginning cash balance and

Q146: The standard fixed overhead rate is often

Q157: The calculation of Economic Value Added is<br>A)

Q165: Refer to Figure 7-5. Calculate the total