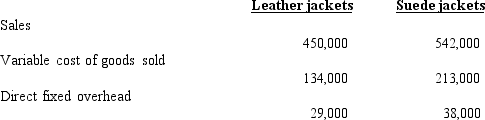

Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

Definitions:

Progressive Discipline

A method of employee discipline that applies increasingly severe penalties for repeated offenses.

Respondeat Superior

The legal doctrine that imposes liability on employers and makes them pay for torts committed by their employees within the scope of the employer’s business. Literally translated, it means “Let the master respond.”

Non-delegable Duty

A legal obligation that cannot be transferred to another party and must be performed by the individual or entity to whom it is assigned.

Tort

A private wrong that injures another person’s physical well-being, property, or reputation.

Q1: Garcia Company uses the weighted average method

Q2: Producing 10,000 units of a cell phone

Q15: combines beginning inventory costs and work done

Q47: The _ can be used to compute

Q60: Assume that a company takes 3,500 hours

Q81: Accurate _ allow managers to make better

Q92: computation of unit cost

Q151: The solution for different percentage completion figures

Q152: Standard costs are developed for direct materials,

Q165: The _ measures the difference between the