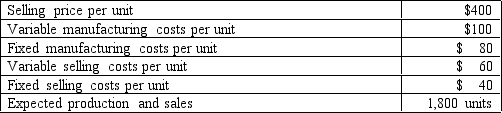

Aaron Company provided the following data for next month:

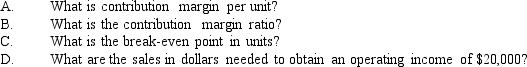

Required:

Required:

Definitions:

Average Net Property

This term typically refers to the average value of a company's property, plant, and equipment net of depreciation, over a certain period of time.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Estimated Useful Life

The expected period over which a company anticipates deriving benefits from an asset before it becomes obsolete or too costly to maintain.

Units-Of-Production Depreciation

A depreciation method that allocates the cost of an asset over its useful life based on its output or usage rather than the passage of time.

Q5: A professor's salary at a university

Q41: Control activities are performed by an organization

Q46: Which of the following would probably be

Q54: factory supplies

Q55: Olson Company makes hearing aids. Olson has

Q63: Refer to Figure 3-6. If output was

Q111: A cost that increases in total as

Q148: Describe the differences between process costing and

Q150: See the following separate cases.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8702/.jpg"

Q179: Refer to Figure 4-8. How much sales