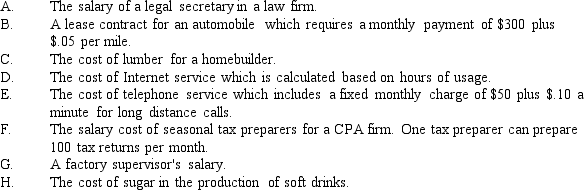

Consider each of the following independent situations.

Required: For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost.

Required: For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost.

Definitions:

Straight-Line Depreciation

A process for dividing the cost of an asset equally over the duration of its usability.

After-Tax Discount Rate

This rate is used to discount future cash flows to their present value, considering the effect of taxes.

Incremental Sales

The additional revenue generated from a specific marketing or sales effort, beyond the expected or baseline sales level.

Income Tax Rate

The segment of income that governments require individuals and corporations to pay as tax.

Q3: DC motors are generally operated at or

Q20: In a circuit with _ power sources,

Q72: Refer to Figure 6-1. Department Z's cost

Q88: Information from the records of Cain Corporation

Q89: salary of receptionist

Q106: Explain the role of the departmental production

Q168: A fixed cost is a cost that

Q207: If production volume increases from 8,000 to

Q216: Refer to Figure 3-9. The term $242<br>A)

Q235: factory janitorial costs