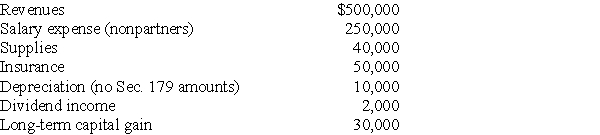

AT Pet Spa is a partnership owned equally by Travis and Ashley. The partnership had the following revenues and expenses this year. Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

Salvage Value

The estimated sell-back value of an asset once it surpasses its life of effectiveness.

Book Value

The net value of a company's assets minus its liabilities, representing the shareholders' equity on a per share basis.

Loss on Disposal

The financial loss incurred when the selling price of an asset is less than its carrying amount at the time of disposal.

Patent

An exclusive right issued by the U.S. Patent Office that enables the recipient to manufacture, sell, or otherwise control an invention for a period of 20 years from the date of the grant.

Q3: Identify which of the following statements is

Q6: Which one of the following groups represents

Q7: Discuss the advantages and disadvantages of a

Q31: Jerry purchased land from Winter Harbor Corporation,

Q38: Jeremey is a partner in the Jimmy

Q42: Conflict theorists focus on how the 'parts'

Q56: When using the Bardahl formula, an increase

Q77: Martin is a limited partner in a

Q78: The treatment of capital loss carrybacks and

Q96: Which one of the following is an