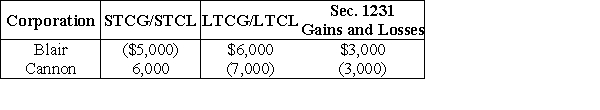

Blair and Cannon Corporations are the two members of an affiliated group. No prior net Sec. 1231 losses have been reported by any group member. The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows:  Included in the above totals is $6,000 of long-term capital losses recognized by Cannon on an intercompany transaction. Excluded from the above is a $4,000 Sec. 1231 gain originally deferred by Cannon that must be reported by the group in the current year. Which one of the following statements is incorrect?

Included in the above totals is $6,000 of long-term capital losses recognized by Cannon on an intercompany transaction. Excluded from the above is a $4,000 Sec. 1231 gain originally deferred by Cannon that must be reported by the group in the current year. Which one of the following statements is incorrect?

Definitions:

Passengers

Individuals or customers who use transportation services such as airplanes, buses, trains, or ships for traveling from one place to another.

Wages And Salaries

Remuneration provided to workers for their work, encompassing both wages by the hour and set salaries.

Spending Variance

A financial metric indicating the difference between the budgeted or planned amount of expenses and the actual amount spent.

Net Operating Income

A company's profit after subtracting its operating expenses, excluding taxes and interest.

Q9: Émile Durkheim defined social facts as<br>A)census statistics.<br>B)having

Q19: A trial explanation predicting a relationship between

Q22: If an individual pursues a university degree

Q33: A partner's share of nonrecourse debt increases

Q48: _ suicide occurs when individuals kill themselves

Q64: Prince Corporation donates inventory having an adjusted

Q65: Decolonisation presents an alternative explanation for the

Q68: Gandhi is an important figure who led

Q100: Peach Corporation was formed four years ago.

Q109: Boxer Corporation buys equipment in January of