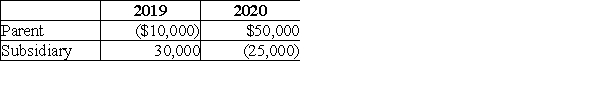

Parent and Subsidiary Corporations form an affiliated group. In 2019, the initial year of operation, Parent and Subsidiary filed separate returns. In 2020, the group files a consolidated tax return. The results for 2019 and 2020 are: Taxable Income  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

After Conception

Refers to the period of time following the fertilization of an egg by a sperm, marking the beginning of pregnancy.

Differential Sensitivity

The concept that individuals vary in their responsiveness to the same environmental stimuli.

Genes

Units of heredity made up of DNA, responsible for determining the characteristics and traits passed from parents to offspring.

Vulnerable

Exposed to the possibility of being attacked or harmed, either physically or emotionally.

Q6: The following information is reported by Acme

Q7: Albert receives a liquidating distribution from Glidden

Q12: Stan had a basis in his partnership

Q25: Sun and Moon Corporations each have only

Q28: _ is first-hand knowledge gained by living

Q39: A woman writes, 'I can't be anything

Q41: A partner's basis for his or her

Q43: Identify which of the following statements is

Q59: Durkheim wrote, 'Even when, in fact, I

Q72: In a Type B reorganization, the acquiring