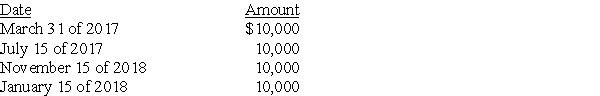

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

Definitions:

Trade Credit

Debt arising from credit sales and recorded as an account receivable by the seller and as an account payable by the buyer.

Discounts

A reduction from the usual cost of something, often applied to prompt payment or to certain categories of customers.

Increase

A rise in value, quantity, or some other measure.

Trade Discount

A reduction from the list price given by a seller to a buyer, often based on the volume of the transaction or to incentivize early payment.

Q1: Apple Corporation and Banana Corporation file consolidated

Q15: Booth Corporation sells a building classified as

Q57: Johnson Co. transferred part of its assets

Q60: Blueboy Inc. contributes inventory to a qualified

Q71: The term _ describes a state in

Q72: Identify which of the following statements is

Q80: Identify which of the following statements is

Q84: What are the tax consequences of a

Q85: How do intercompany transactions affect the calculation

Q112: From a sociological perspective, high unemployment can