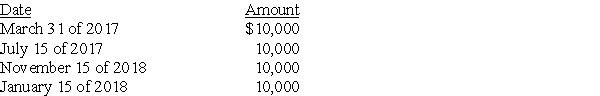

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

Definitions:

Economic Growth

The increase in the market value of the goods and services produced by an economy over time, typically measured as the percent rate of increase in real gross domestic product (GDP).

Baby Boomers

A demographic group defined by the significant increase in birth rates following World War II, typically considered born between 1946 and 1964.

Age Seniority

The system or practice of giving precedence, respect, or authority to individuals based on their age, often found in traditional societies.

South Korean

Pertaining to or originating from South Korea, a country in East Asia located on the southern half of the Korean Peninsula.

Q16: All of the following are recognized as

Q23: The RT Limited Partnership incurs the following

Q30: Rock Corporation acquires all of the assets

Q36: Alto and Bass Corporations have filed consolidated

Q36: Which one of the following classical sociologists

Q45: Karl Marx described capitalism in all but

Q52: When in a nation of 50 million

Q83: Splash Corporation has $50,000 of taxable income

Q91: Who invented the term sociology?<br>A)Auguste Comte<br>B)Émile Durkheim<br>C)Max

Q98: In a taxable asset acquisition, the purchaser