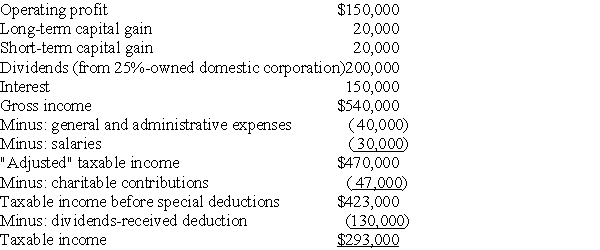

Mullins Corporation is classified as a PHC for the current year, reporting $263,000 of taxable income on its federal income tax return:  Actual charitable contributions made by Mullins Corporation were $75,000. What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000. What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Definitions:

Id

A component of Sigmund Freud's psychoanalytic theory, representing the instinctual drives and the source of psychic energy.

Superego

In psychoanalytic theory, the part of the personality that represents internalized ideals, providing standards for judgment and for future aspirations.

Resistance

In psychology, a phenomenon where individuals show opposition or avoidance in response to certain stimuli or interventions.

Reaction Formation

A defense mechanism where an individual unconsciously replaces undesirable or anxiety-inducing thoughts or feelings with their opposites.

Q2: When computing the accumulated earnings tax, the

Q4: Tracy has a 25% profit interest and

Q36: Alto and Bass Corporations have filed consolidated

Q45: What is the tax treatment for a

Q46: Dan transfers property with an adjusted basis

Q52: Identify which of the following statements is

Q58: Which one of the following statements about

Q61: Bob contributes cash of $40,000 and Carol

Q84: Identify which of the following statements is

Q84: AT Pet Spa is a partnership owned