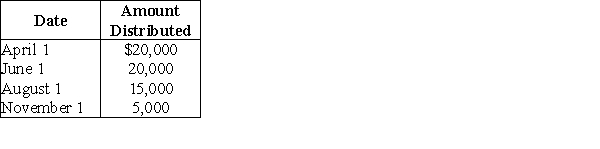

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000. During the year, the corporation makes the following distributions to its sole shareholder:  The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

Definitions:

Biopsychosocial Approach

An integrated approach that considers biological, psychological, and social factors in understanding health, illness, and healthcare delivery.

Self-Focused Rumination

The repetitive and passive focus on one's feelings, problems, and experiences, often leading to emotional distress.

Serotonin Levels

Refers to the concentration of serotonin, a neurotransmitter, in the brain that affects mood, appetite, and sleep.

Depression

A common and serious medical illness that negatively affects how you feel, the way you think, and how you act, leading to a variety of emotional and physical problems.

Q9: Identify which of the following statements is

Q23: Identify which of the following statements is

Q33: On July 25 of the following year,

Q50: Identify which of the following statements is

Q62: Key Corporation distributes a patent with an

Q70: Identify which of the following statements is

Q84: Chris transfers land with a basis of

Q97: When computing E&P and taxable income, different

Q98: Lynn transfers property with a $56,000 adjusted

Q107: Does the contribution of services to a