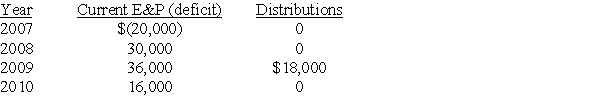

Omega Corporation is formed in 2006. Its current E&P and distributions for each year through 2010 are as follows:  Is the distribution made from current or accumulated E&P? At the beginning of 2011, what is accumulated E&P?

Is the distribution made from current or accumulated E&P? At the beginning of 2011, what is accumulated E&P?

Definitions:

RAM

Random Access Memory, a form of computer memory that can be accessed randomly, used for storing running programs and data.

Computer

An electronic device capable of processing data according to a set of instructions to perform a wide range of tasks.

Operating System

The foundational software that manages computer hardware resources and provides services for computer programs.

Resources

Assets, materials, or other necessities available and utilized to achieve goals, complete projects, or support operations and development.

Q4: A taxpayer will receive a 30-day letter<br>A)to

Q31: The transferor's holding period for any boot

Q37: Which of the following is not a

Q49: Identify which of the following statements is

Q53: Identify which of the following statements is

Q55: Cardinal and Bluebird Corporations both use a

Q56: Identify which of the following statements is

Q59: Poppy Corporation was formed three years ago.

Q60: In a Sec. 338 election, the target

Q75: Boxcar Corporation and Sidecar Corporation, an affiliated