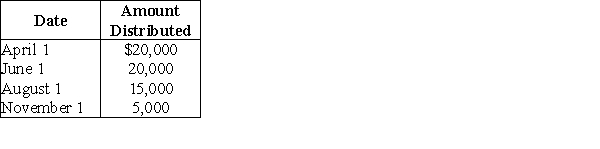

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000. During the year, the corporation makes the following distributions to its sole shareholder:  The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

Definitions:

Estrogen

A group of steroid hormones that play a crucial role in regulating the reproductive system, development of female secondary sexual characteristics, and menstrual cycle.

Triglyceride

Triglycerides are a type of fat (lipid) found in your blood, coming from either dietary fats or produced in the body, used as a source of energy or stored as fat.

Polysaccharide

A complex carbohydrate composed of long chains of monosaccharide units bonded together, serving as energy storage or as structural components.

Starch

Starch is a carbohydrate consisting of a large number of glucose units joined by glycosidic bonds, commonly found in foods and used as an energy source by plants and animals.

Q21: Identify which of the following statements is

Q21: Identify which of the following statements is

Q24: Identify which of the following statements is

Q44: South Corporation acquires 100 shares of treasury

Q55: Tia receives a $15,000 cash distribution from

Q61: Bob contributes cash of $40,000 and Carol

Q75: Webster, who owns all the Bear Corporation

Q86: Which of the following definitions of Sec.

Q90: What are the consequences of a stock

Q91: On April 15, 2018, a married couple