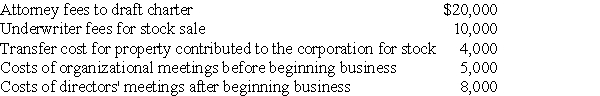

The following expenses are incurred by Salter Corporation when it is organized on July 1:  Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Definitions:

Cofounders' Experience

The collective knowledge, skills, and expertise that founders of a company bring to the venture, influencing its strategy and chances of success.

Angel Investors

Wealthy individuals who provide capital to startups or entrepreneurs, often in exchange for equity stakes, at early stages of business development.

Young Startups

Newly established businesses, typically within the technology sector, that are in the early stages of their operations and are aiming for rapid growth.

Mezzanine Stage

A late-stage of funding in the growth of a company, representing a transition from venture capital financing to public offering or acquisition.

Q1: Mary receives a liquidating distribution from Snell

Q2: Martin operates a law practice as a

Q9: Define intercompany transactions and explain the two

Q31: If a return's due date is extended,

Q35: Paper Corporation adopts a plan of reorganization

Q61: Identify which of the following statements is

Q73: In the current year, Red Corporation has

Q77: Ball Corporation owns 80% of Net Corporation's

Q81: Access Corporation, a large manufacturer, has a

Q82: Identify which of the following statements is