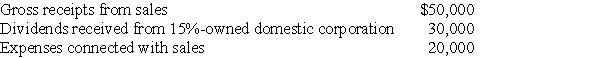

Francine Corporation reports the following income and expense items for the tax year ending December 31:  What is Francine Corporation's taxable income?

What is Francine Corporation's taxable income?

Definitions:

Insurance

A contractual agreement where one party pays premiums in exchange for a promise of compensation for specified potential future losses or damages.

Factory Overhead

All indirect costs associated with manufacturing, excluding direct labor and direct materials, such as utilities, depreciation, and maintenance of equipment.

Product Cost

The total of costs directly tied to the production of a product, including raw material, labor, and overhead.

Oil Lubricants

Substances applied to reduce friction and wear between surfaces in mutual contact, which ultimately extends the life of machinery.

Q9: When computing the accumulated earnings tax, which

Q18: What is a personal holding company?

Q31: Florida Corporation is 100% owned by Lawton

Q36: Taxpayers can avoid the estate tax by

Q36: In a Type B reorganization, the 1.

Q62: Which of the following is deductible in

Q64: U.S. shareholders are not taxed on dividends

Q75: What basis do both the parent and

Q89: Liquidation and dissolution have the same legal

Q104: What is the benefit of the 65-day