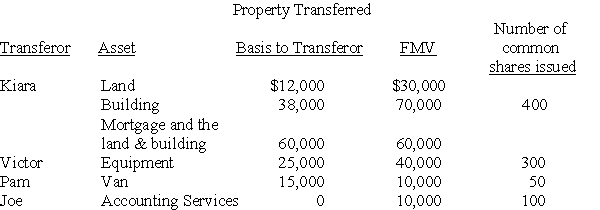

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:  Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec. 351?

b)What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Work Redesign

The process of altering jobs and work processes with the aim of improving organizational performance and employee satisfaction.

Competency Models

Frameworks that define the skill and knowledge requirements for specific jobs or roles within an organization.

Talent Management

The strategic approach to attracting, retaining, and developing skilled individuals to meet organizational needs.

Occupation

A person's job or profession, often characterized by a set of specialized skills, knowledge, and training.

Q7: Albert receives a liquidating distribution from Glidden

Q20: Income in respect of a decedent (IRD)includes

Q40: The City of Portland gives Data Corporation

Q43: Identify which of the following statements is

Q48: Identify which of the following statements is

Q57: A foreign corporation with a single class

Q67: The "automatic" extension period for filing an

Q89: Darnell, who is single, exchanges property having

Q94: Identify which of the following statements is

Q95: In general, a noncorporate shareholder that receives