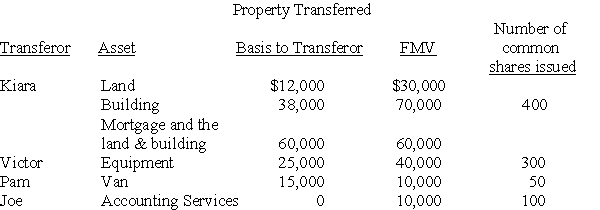

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:  Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec. 351?

b)What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Ineffective Breathing Pattern

A respiration problem where an individual's breathing is not sufficient to support optimal gas exchange.

Incisional Pain

Pain that occurs at the site of a surgical incision, often experienced after surgery as the wound heals.

Shallow Respirations

Breathing that is abnormally rapid and not deep enough, potentially leading to decreased oxygen intake and buildup of carbon dioxide.

Anesthesia

Medication used to prevent pain during surgery by causing loss of sensation or consciousness.

Q30: The Sec. 318 family attribution rules can

Q30: A medical doctor incorporates her medical practice,

Q32: Corporate distributions that exceed earnings and profits

Q41: A liquidation must be reported to the

Q55: The conduit approach for fiduciary income tax

Q56: Explain the difference in tax treatment between

Q59: Identify which of the following statements is

Q64: U.S. shareholders are not taxed on dividends

Q93: List some common examples of principal and

Q108: Jeremy operates a business as a sole