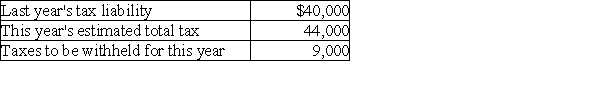

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty. Assume your client's adjusted gross income last year was $140,000.

Definitions:

Interest Rates

The cost of borrowing money or the return for investing money, usually expressed as a percentage of the principal amount.

Future Dollars

Currency value projected at a future date, often used in the context of inflation or investment growth.

Net Present Value

The difference between the present value of cash inflows and outflows over a period of time, used in capital budgeting to assess the profitability of an investment.

Cash Flows

The aggregate sum of funds flowing in and out of a company, particularly influencing its liquid assets.

Q1: Bart has a partnership interest with a

Q2: Bat Corporation distributes stock rights with a

Q4: Two years ago, Tom contributed investment land

Q27: By electing to use the S corporation's

Q33: On July 25 of the following year,

Q33: Trail Corporation has gross profits on sales

Q36: Explain the four conditions that must be

Q42: Island Corporation has the following income and

Q77: The statute of limitations is unlimited for

Q99: The IRS will issue a 90-day letter