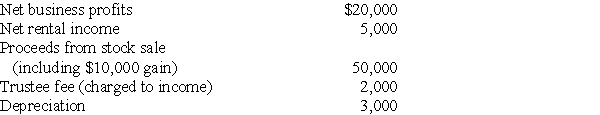

A trust document does not define income or principal. The state in which the trust is operated has adopted the Uniform Act, including allocation of depreciation to income. The trust reports the following:  What is the amount of the trust's net accounting income?

What is the amount of the trust's net accounting income?

Definitions:

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or the normal operating cycle, whichever is longer.

Intangible

Assets that lack physical substance but are identifiable and provide economic benefits, such as patents and trademarks.

Copyright

A form of intellectual property protection that grants the creator exclusive rights to use, distribute, and replicate their original work.

Exclusive Right

A legal entitlement granting the holder sole permission to perform a specific action or use a particular property.

Q22: Revocable trusts means<br>A)the transferor may not demand

Q22: Which of the following statements is incorrect?<br>A)Limited

Q44: The Williams Trust was established six years

Q49: Identify which of the following statements is

Q63: Compare the foreign tax payment claimed as

Q70: In order to appeal to the Appeals

Q71: Wills Corporation, which has accumulated a current

Q74: Once a corporation has elected a taxable

Q84: A foreign corporation is a CFC that

Q111: Identify which of the following statements is