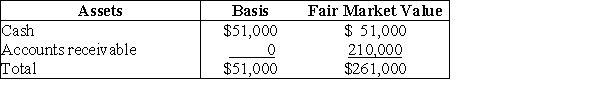

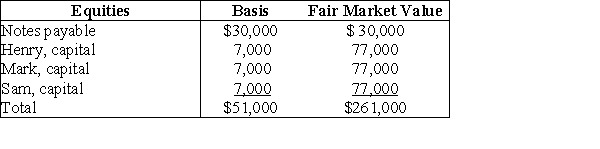

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities)at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities)at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Q6: Surveys today may find that few people

Q6: W.E.B.Du Bois argued that the primary responsibility

Q7: Identify which of the following statements is

Q7: Proceeds of a life insurance policy payable

Q22: Which Hispanic group has the highest median

Q22: If the transferor partner receives payment for

Q23: For Anglophones and Francophones in modern day

Q25: Which generation of Japanese American immigrants has

Q79: Cactus Corporation, an S Corporation, had accumulated

Q100: The term "tax law" includes<br>A)legislation.<br>B)treasury regulations.<br>C)judicial decisions.<br>D)all