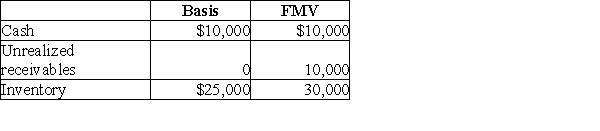

The XYZ Partnership owns the following assets on December 31:  A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution of $10,000 cash. XYZ Partnership has no liabilities. His recognized gain is

A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution of $10,000 cash. XYZ Partnership has no liabilities. His recognized gain is

Definitions:

Model

A representation, either physical, mathematical, or conceptual, used to describe, explain, or predict phenomena in the real world.

Exposed

Being subject to something or made vulnerable to its effects.

Groupthink

A phenomenon where the desire for harmony or conformity in a group leads to irrational or dysfunctional decision-making outcomes.

Illusion of Invulnerability

A cognitive bias in which a person or group overestimates their immunity from harm or negative outcomes, often leading to risk-taking behaviors.

Q7: Dominicans resemble Puerto Ricans most in their:<br>A)citizenship

Q10: Connie's Restaurant has been an S corporation

Q15: Davies Corporation is a calendar-year taxpayer that

Q17: Which of the following is a primary

Q30: Immigrants most similar in culture and appearance

Q37: Yuli wants to help his adult grandson,

Q38: Which of the following transfers is subject

Q42: What is a permitted year?

Q84: An estate made a distribution to its

Q93: Which regulation deals with Code Section 165?<br>A)Reg.