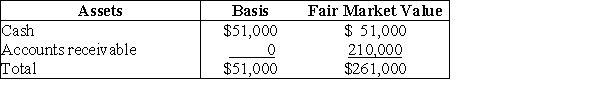

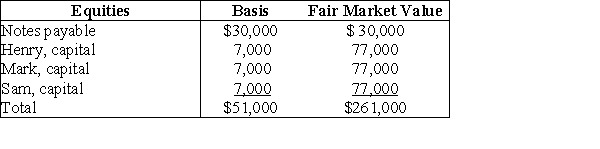

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities)at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities)at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Essential Information

Essential information refers to critical data or facts that are necessary for understanding a context, making decisions, or solving problems.

Communication

The process of transmitting information, ideas, feelings, or messages from one person or group to another through various means.

Communication Technology

Tools and platforms that facilitate the exchange of information and communication, such as telephones, email, and social media.

Blog Feeds

A stream of updates or the latest posts from a blog, often made available to readers through subscriptions.

Q24: A partner's holding period for property distributed

Q34: What is "forum-shopping"?

Q37: Identify which of the following statements is

Q59: Discuss the ways in which the estate

Q61: Robert Elk paid $100,000 for all of

Q64: Marc is a calendar-year taxpayer who owns

Q67: An electing S corporation has a $30,000

Q69: Identify which of the following statements is

Q70: A simple trust has the following results:

Q94: Identify which of the following statements is