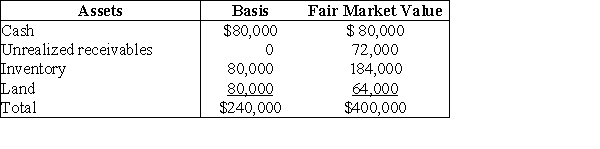

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:  The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

Definitions:

Alt Key

A modifier key on keyboards used to alter the function of other keys, enabling access to additional functionalities.

Enter Key

A key on a computer keyboard which is used to perform a variety of functions, such as executing commands or as a carriage return in text editing.

Insert Key

A function allowing users to insert or add new data into a specific location within a database or document.

Undo

A command in computer software that reverses the last command or action performed, allowing users to revert changes.

Q11: On November 30, Teri received a current

Q12: Kenya sells her 20% partnership interest having

Q13: Final regulations can take effect on any

Q18: The Tax Court departs from its general

Q23: Explain how to determine the deductible portion

Q24: The essential idea of the "melting pot"

Q25: Trusts that can own S corporation stock

Q31: Consider the statement that Abraham Lincoln made

Q32: Alligood Corporation has two classes of common

Q56: A partner can recognize gain, but not