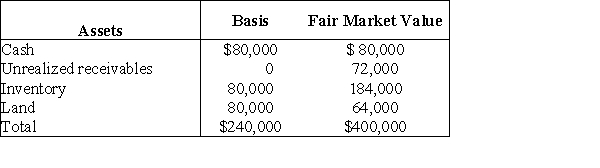

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:  The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the allocation of Tony's gain to the assets received?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the allocation of Tony's gain to the assets received?

Definitions:

Involuntary Dissolution

The forced termination of a corporation's existence by court order, often initiated by the state for legal or regulatory reasons.

Secretary of State

is a high-ranking official in the government responsible for foreign affairs and diplomatic activities, or in some countries, domestic affairs.

Annual Report

A comprehensive summary of a company's performance, activities, and financial health over a fiscal year, provided to shareholders and regulators.

Ethical Behavior

Acting in ways consistent with societal standards of right and wrong.

Q2: Identify which of the following statements is

Q2: Which of the following characterizes ethnic prejudice?<br>A)It

Q2: Identify which of the following statements is

Q3: The most sizable population of contemporary black

Q4: Brazil was formed through:<br>A)Italian conquest.<br>B)British conquest.<br>C)Portuguese conquest.<br>D)Spanish

Q69: Jack transfers property worth $250,000 to a

Q73: Tenika has a $10,000 basis in her

Q86: Discuss the negative aspects of gifts.

Q95: Identify which of the following statements is

Q96: Gordon died on January 1 and by