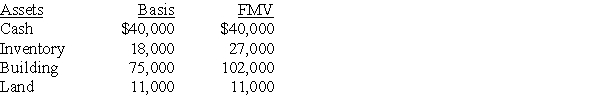

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000. On the date of sale, the partnership has no liabilities and the following assets:  The building is depreciated on a straight-line basis. What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis. What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Job Enlargement

Job design that expands an employee’s responsibilities by increasing the number and variety of tasks assigned to the worker.

Job Enrichment

Change in job duties to increase employees’ authority in planning their work, deciding how it should be done, and learning new skills.

Job Sharing

An employment arrangement where two or more individuals share the responsibilities and duties of a single full-time job.

Job Management

The process of overseeing, scheduling, and controlling the tasks and responsibilities within an organization to ensure that they are completed as required.

Q4: Which of the following factors is most

Q6: Jerry has a $50,000 basis for his

Q17: Ebony Trust was established two years ago

Q17: When examining the level of assimilation among

Q20: Identify which of the following statements is

Q40: The AB, BC, and CD Partnerships merge

Q49: In a current distribution, the partner's basis

Q54: An S corporation is permitted an automatic

Q67: Identify which of the following statements is

Q80: Administrative expenses are not deductible on the