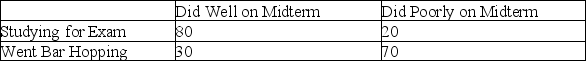

TABLE 4-2

An alcohol awareness task force at a Big-Ten university sampled 200 students after the midterm to ask them whether they went bar hopping the weekend before the midterm or spent the weekend studying, and whether they did well or poorly on the midterm. The following result was obtained.

-Referring to Table 4-2, the events "Did Well on Midterm" and "Studying for Exam" are

Definitions:

IRA

Individual Retirement Account, a saving tool for individuals to allocate funds for retirement with tax advantages.

American Opportunity Tax Credit

A rebate on legitimate educational expenditures for a qualifying student throughout the first four years of their university or college education.

Qualified Expenses

Expenses eligible for tax deduction or credit, typically in the context of education, healthcare, or investments.

AGI Limitation

A constraint or cap based on an individual's adjusted gross income (AGI) which affects eligibility for certain tax deductions, credits, or contributions.

Q11: Referring to Table 3-4, the five-number summary

Q30: Referring to Table 1-2, the 2,150 adults

Q54: Sampling distributions describe the distribution of<br>A) parameters.<br>B)

Q71: To ethically advertise a school lottery scheme

Q82: Referring to Table 4-8, what is the

Q83: Referring to Table 1-1, the possible responses

Q99: A statistic is usually used to provide

Q127: Referring to Table 2-13, if a relative

Q142: In general, a frequency distribution should have

Q194: Which of the following is true about