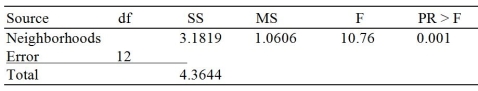

TABLE 10-17

A realtor wants to compare the mean sales-to-appraisal ratios of residential properties sold in four neighborhoods (A, B, C, and D) . Four properties are randomly selected from each neighborhood and the ratios recorded for each, as shown below.

A: 1.2, 1.1, 0.9, 0.4 C: 1.0, 1.5, 1.1, 1.3

B: 2.5, 2.1, 1.9, 1.6 D: 0.8, 1.3, 1.1, 0.7

Interpret the results of the analysis summarized in the following table:

-Referring to Table 10-17, the within group mean squares is ________.

Definitions:

Homemade Leverage

refers to the strategy wherein investors adjust the amount of leverage or debt in their investment portfolios on their own, rather than relying on the borrowing strategy of the companies in which they invest.

M&M Proposition

The Modigliani and Miller Proposition, theories that address the impact of capital structure on a company's value and cost of capital.

Homemade Leverage

A strategy where investors adjust the amount of leverage in their own portfolios by borrowing or lending money to replicate corporate financial leverage.

Q2: How many tissues should the Kimberly Clark

Q33: Referring to Table 11-9, at 5% level

Q73: Referring to Table 11-13, how many children

Q74: Referring to Table 9-8, what will be

Q75: Suppose we wish to test H₀: μ

Q94: Referring to Table 12-11, which of the

Q133: Referring to Table 9-9, the evidence proves

Q175: Referring to Table 10-7, what is the

Q232: Referring to Table 10-15, suppose α =

Q290: The coefficient of multiple determination r²Y.₁₂<br>A) measures