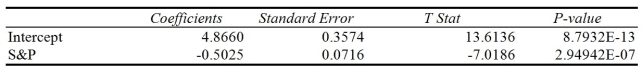

TABLE 12-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 Index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 Index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 Index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 Index at a 5% level of significance. The results are given in the following Microsoft Excel output.

Note: 2.94942E-07 = 2.94942 * 10-7

-Referring to Table 12-7, which of the following will be a correct conclusion?

Definitions:

Hearing Loss

A partial or total inability to hear. It can occur in one or both ears and range from mild to severe.

Loud Noises

Intense auditory stimuli that can potentially cause hearing loss or stress, often considered undesirable or disruptive.

Color Vision Theories

The explanations and hypotheses that describe how the human eye perceives colors, including the trichromatic and opponent-process theories.

Trichromatic Theory

A theory of color vision that explains how humans perceive color through the response of three types of cones sensitive to different wavelengths.

Q11: Referring to Table 10-10, if the firm

Q20: When testing for differences between the means

Q54: Referring to Table 14-8, an R chart

Q61: Referring to Table 13-13, the predicted demand

Q75: Referring to Table 13-4, one individual in

Q88: Referring to Table 11-5, the value of

Q99: The squared difference between the observed and

Q203: In trying to construct a model to

Q231: Referring to Table 10-18, what should be

Q268: In testing for differences between the means