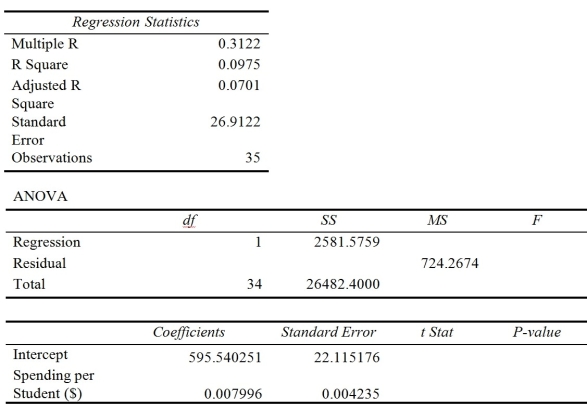

TABLE 12-13

In this era of tough economic conditions, voters increasingly ask the question: "Is the educational achievement level of students dependent on the amount of money the state in which they reside spends on education?" The partial computer output below is the result of using spending per student ($) as the independent variable and composite score, which is the sum of the math, science, and reading scores, as the dependent variable on 35 states that participated in a study. The table includes only partial results.

-Referring to Table 12-13, the decision on the test of whether composite score depends linearly on spending per student using a 10% level of significance is to ________ (reject or not reject)H₀.

Definitions:

Depreciation Tables

Charts provided by the IRS to assist taxpayers in calculating the depreciation expense of an asset for tax purposes over its useful life.

Four-Plex

A residential building divided into four separate units or apartments, each functioning as a separate dwelling.

Net Rental Income

The profit derived from renting out property after deducting all allowable expenses related to the rental activity.

Standard Mileage Rate

The Standard Mileage Rate is a set rate per mile established by the IRS that taxpayers can use to calculate deductible vehicle expenses for business, medical, moving, or charitable purposes.

Q14: Referring to Table 12-11, what is the

Q67: Referring to Table 14-9, based on the

Q78: Referring to Table 14-3, suppose the analyst

Q83: Referring to Table 13-9, if variables that

Q91: You give a pre-employment examination to your

Q140: Referring to Table 13-16, the error appears

Q189: The coefficient of multiple determination measures the

Q224: Referring to Table 13-10, the multiple regression

Q247: Referring to Table 10-13, what assumptions are

Q283: Referring to Table 13-9, the value of