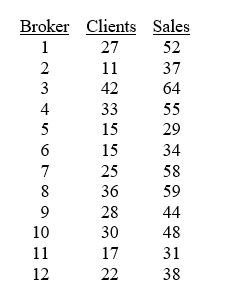

TABLE 12-4

The managers of a brokerage firm are interested in finding out if the number of new clients a broker brings into the firm affects the sales generated by the broker. They sample 12 brokers and determine the number of new clients they have enrolled in the last year and their sales amounts in thousands of dollars. These data are presented in the table that follows.

-Referring to Table 12-4, the managers of the brokerage firm wanted to test the hypothesis that the population slope was equal to 0. For a test with a level of significance of 0.01, the null hypothesis should be rejected if the value of the test statistic is ________.

Definitions:

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in product costs.

Absorption Costing

A bookkeeping technique that encases the entirety of manufacturing expenses such as direct materials, direct labor, along with both variable and fixed overhead costs, in the product’s cost.

Divisional Segment Margin

A measure of the profitability of a specific division or segment within a company, usually calculated as the division's earnings before interest and taxes divided by its revenues.

Net Operating Income

A company's revenue minus its operating expenses, not including taxes and interest charges.

Q37: Referring to Table 13-16, there is enough

Q62: Referring to Table 10-12, the null hypothesis

Q63: The Wall Street Journal recently published an

Q81: A powerful women's group has claimed that

Q100: Referring to Table 12-12, there is a

Q102: Referring to Table 9-8, the largest level

Q127: Referring to Table 10-18, the test is

Q128: Referring to Table 13-16, the 0 to

Q190: Referring to Table 10-18, the decision made

Q200: Referring to Table 12-10, construct a 95%