TABLE 13-4

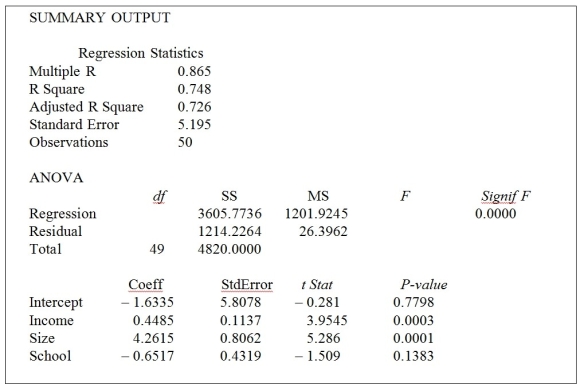

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 13-4, suppose the builder wants to test whether the coefficient on School is significantly different from 0. What is the value of the relevant t-statistic?

Definitions:

Interest Income

Earnings from interest-bearing financial assets, such as loans, bonds, and savings accounts.

Capital Gains

The earnings obtained from an asset or investment when the sale price is higher than the initial buying price.

Marginal Tax Rates

The amount of tax paid on an additional dollar of income, which varies according to the income bracket of the taxpayer.

Provincial Tax Brackets

These are income range segments established by provincial governments in Canada, where each range is taxed at a specific rate, affecting how much income tax a person pays based on their income.

Q11: In May 2014,the typical CEO earned approximately

Q44: Both employers and employees finance Medicare Part

Q85: Referring to Table 10-12, construct a 95%

Q98: Referring to Table 12-4, the error or

Q139: Referring to Table 10-17, the critical value

Q185: Referring to Table 12-4, the coefficient of

Q196: Referring to Table 12-3, the director of

Q206: Referring to Table 12-12, there is sufficient

Q221: Referring to Table 10-17, the null hypothesis

Q259: A multiple regression is called "multiple" because