TABLE 13-7

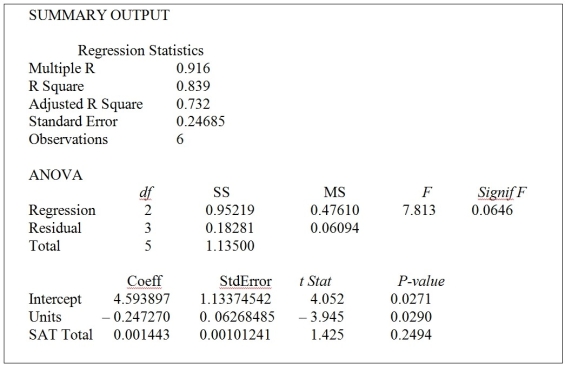

The department head of the accounting department wanted to see if she could predict the GPA of students using the number of course units (credits) and total SAT scores of each. She takes a sample of students and generates the following Microsoft Excel output:

-Referring to Table 13-7, the department head wants to use a t test to test for the significance of the coefficient of X₁. The p-value of the test is ________.

Definitions:

Federal Form 940

A United States tax form used by employers to report annual Federal Unemployment Tax Act (FUTA) tax.

Unemployment Tax

A tax paid by employers based on the total payroll and the unemployment claims filed by former employees, financing unemployment benefit programs.

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Federal Form 941

A quarterly tax form used by employers to report federal withholdings from employees.

Q20: If we use the χ² analysis to

Q21: These compensation systems go a long way

Q28: This group is directly involved in producing

Q32: How many days will Jamal have to

Q36: Explain the reasons why employers hire temporary

Q46: The width of the prediction interval for

Q89: Referring to Table 12-4, suppose the managers

Q90: Referring to Table 11-12, how many children

Q170: Referring to Table 10-18, what is the

Q199: Referring to Table 13-15, what is the