TABLE 13-4

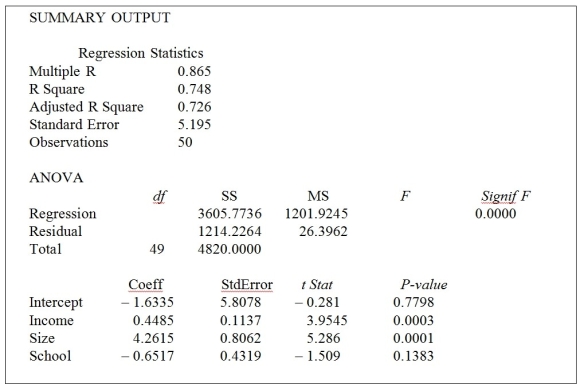

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 13-4, what minimum annual income would an individual with a family size of 9 and 10 years of education need to attain a predicted 5,000 square foot home (House = 50) ?

Definitions:

Premiums And Discounts

Terms related to the bond market; premiums occur when a bond's price is higher than its face value, and discounts when it's sold below face value, affecting its yield.

Bond Investments

Financial securities that represent a loan made by an investor to a borrower, typically corporate or governmental, that pays periodic interest payments and the return of principal at maturity.

Interest Income

Earnings received from investments in debt instruments such as bonds, loans, or savings accounts.

Carrying Amount

The value at which an asset or liability is recognized on the balance sheet, factoring in depreciation or amortization and impairment if applicable.

Q9: Under which law must former employees be

Q14: Referring to Table 13-14, the predicted mileage

Q28: Which organization has as one of its

Q38: Approximately _ percent of Americans experience some

Q38: Referring to Table 11-6, what are the

Q79: Referring to Table 11-11, the p-value of

Q103: Referring to Table 13-4, suppose the builder

Q114: The residuals represent<br>A) the difference between the

Q132: Referring to Table 13-16, what is the

Q247: Referring to Table 13-4, what are the