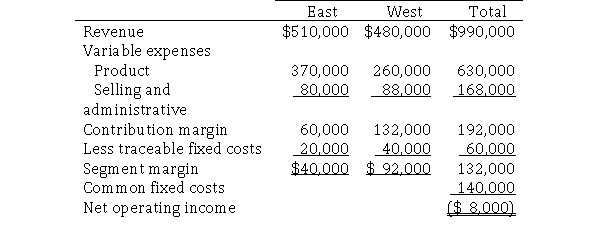

Nobles Corporation provided the following segment margin income statement for two of its divisions: East and West.  Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets ($60,000 current and $240,000 long-term) and $320,000 of liabilities ($120,000 current and $200,000 long-term).The West division reported $360,000 of assets ($80,000 current and $280,000 long-term) and $260,000 of liabilities ($60,000 current and $200,000 long-term).

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets ($60,000 current and $240,000 long-term) and $320,000 of liabilities ($120,000 current and $200,000 long-term).The West division reported $360,000 of assets ($80,000 current and $280,000 long-term) and $260,000 of liabilities ($60,000 current and $200,000 long-term).

Required:

a.Calculate the economic value added for each division.

b.Which of the two managers will be rated higher on performance? Why?

Definitions:

Motivation

The process that initiates, guides, and maintains goal-oriented behaviors; it is what causes individuals to act or behave in a certain way to fulfill their needs or desires.

Test Scores

Quantitative measures obtained from educational or psychological tests that reflect the test-taker's performance.

Dependent Variable

In scientific research, the variable that is being tested and measured, which is expected to change under the influence of the independent variable.

Independent Variable

In scientific research, the variable that is manipulated or changed to examine its effects on a dependent variable.

Q6: Jackson Brothers Instruments sells stringed instruments.Trent Jackson,

Q8: Which of the following will probably not

Q8: As decision windows and operating cycles continue

Q20: Capital budgeting differs from cash budgeting in

Q23: Which of the following is not an

Q52: The last step in the preparation of

Q91: A characteristic of non-value-added activities is that

Q97: On a common-size income statement, income taxes

Q112: Holding all other things equal, the ROI

Q184: A segment of an organization is any