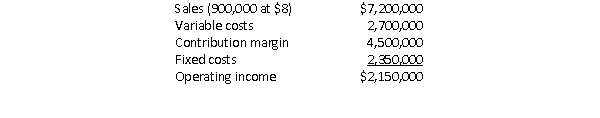

Impala Industries manufactures a component used by car manufacturers.Impala can produce 1,000,000 components per year.A foreign car manufacturer has approached Impala with an offer to purchase 120,000 components at price of $6 per unit.Impala's results for last year are as follows:  If Impala accepts the offer, it will only be able to sell 880,000 units at the regular price due to its capacity constraints.What will Impala's total operating income be next year if it accepts the offer?

If Impala accepts the offer, it will only be able to sell 880,000 units at the regular price due to its capacity constraints.What will Impala's total operating income be next year if it accepts the offer?

Definitions:

High-Technology Inventors

Individuals or groups involved in the creation or development of new products or innovations in high-tech industries.

Prototype

An early sample, model, or release of a product built to test a concept or process, serving as a thing to be replicated or learned from.

Initial Public Offerings (IPOs)

The process through which a private company goes public by selling its shares to the general public for the first time.

Mezzanine Investors

Investors who provide capital to businesses in the form of subordinated debt or preferred equity, often representing a middle layer of financing between senior debt and common equity.

Q7: Under activity-based costing, selling and administrative costs

Q38: When a company continues to manufacture a

Q47: Keltner Enterprises is considering investing in a

Q64: The payback period measures<br>A)the present value of

Q66: R&N Sports has budgeted $57,000 for fixed

Q76: The formula for calculating ROI is<br>A)segment margin

Q97: Place and "X" in the column that

Q147: City Retail sells two products: Standard and

Q159: Adler Industries uses a standard cost system.Adler

Q171: Assume you have been hired by a