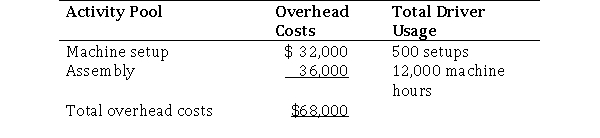

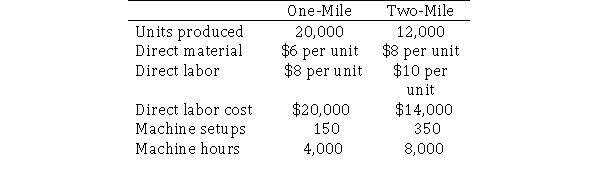

Camping Suppliers, Inc.manufactures two types of safety strobe lights, one that is visible for one mile and one that is visible for two miles.Manufacturing overhead has been applied on the basis of direct labor costs.Camping Suppliers has gathered some activity information and is interested in implementing an activity-based costing system.The company wants all overhead costs to be allocated to products.The overhead cost pools and activity drivers are as follows:  Other product information is as follows:

Other product information is as follows:  Required:

Required:

a.Using the traditional method, calculate the predetermined overhead rate as a percentage of direct labor cost.

b.Using the activity-based costing approach, determine the two activity rates.

c.Using the activity-based costing approach, determine the unit product cost for the one-mile light.

Definitions:

Q5: The predetermined overhead rate is calculated by<br>A)dividing

Q81: Before you can calculate the present value

Q103: In the activity identification stage of implementing

Q111: Which of the following is not a

Q116: The accounting rate of return differs from

Q125: In calculating the net present value of

Q150: Morrow Co.produces 3 products: Beta, Delta, and

Q152: Which of the following is not a

Q159: Raw Materials Inventory increases when<br>A)materials are purchased.<br>B)materials

Q160: If a product has a positive segment