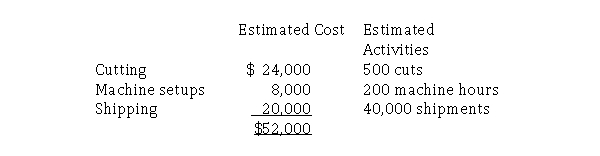

Clover Manufacturing Company makes two products.Using the traditional allocation method, the company has allocated overhead based on estimated total direct labor cost of $125,000.Clover recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: cutting, machine setups, and shipping.The following is a summary of company information:  Required:

Required:

a.Calculate the company's overhead rate as a percentage of direct labor cost.

b.Calculate the company's overhead rates using the activity-based costing pools.

Definitions:

Whooping Cough

A highly contagious respiratory tract infection characterized by severe coughing fits and a distinctive "whooping" sound when inhaling.

Pertussis

A highly contagious respiratory disease also known as whooping cough, caused by the bacterium Bordetella pertussis.

Sensitivity

Abnormal susceptibility to a substance.

Abnormal Susceptibility

An increased likelihood of developing certain conditions or diseases compared to the general population.

Q5: R&N Manufacturing produces music boxes.The fixed overhead

Q33: The flexible budget variance for materials has

Q39: Which of the following is a method

Q44: Felder's manufacturing is considering the purchase of

Q55: Mallory Manufacturing produces thermal tents and sleeping

Q60: Variances have very important meanings, even before

Q70: Which of the following variances would not

Q143: The final component of the operating budget

Q151: Betty's Bakery needs to purchase a new

Q161: In which of the following decisions do