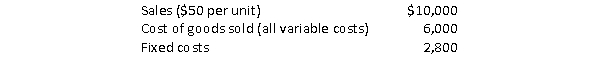

Use the information provided below to answer the following questions:  Required:

Required:

a.How many units would the company need to sell to earn $4,000 in operating income?

b.How many units would the company need to sell to earn $4,000 in net income if the tax rate is 20%?

c.By how much would operating income change from part (b) with a 10% increase in units sold?

Definitions:

Inelastic Supply

A situation where the quantity of a good supplied by producers is relatively insensitive to changes in its price.

Tax Burden

The total amount of taxes that individuals or businesses are required to pay to government entities, often expressed as a percentage of income or profit.

Elasticity

A measure in economics to show how the quantity demanded or supplied of a good or service responds to a change in price.

Price Ceiling

A legally imposed maximum price on a good or service, intended to keep prices low for buyers.

Q5: A semicircular shape has a diameter of

Q5: The predetermined overhead rate is calculated by<br>A)dividing

Q5: Calculate the volume of a cylindrical shape,

Q126: ABC Corporation allocates overhead based on direct

Q145: Contribution margin = Sales revenue - Total

Q146: Firms can manage their degree of operating

Q152: The contribution margin per unit will change

Q153: Which of the following is an example

Q186: All other things equal, a company can

Q195: Silver Moon Boutique sells a line of