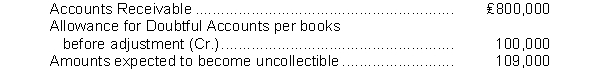

An analysis and aging of the accounts receivable of Downs Company at December 31 revealed the following data:  The cash realizable value of the accounts receivable at December 31, after adjustment, is:

The cash realizable value of the accounts receivable at December 31, after adjustment, is:

Definitions:

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed, calculated as gross income minus deductions and exemptions.

Monthly Salary

The amount of money an employee is paid each month for their job performance, not including bonuses or overtime pay.

Net Pay

The amount of an employee's earnings after all deductions, such as taxes and retirement contributions, have been removed.

FICA Tax

The Federal Insurance Contributions Act (FICA) tax is a payroll tax in the United States that is required from both employers and employees to support Social Security and Medicare programs.

Q3: Rooney Company incurred $280,000 of research costs

Q10: Franco Company credits its Sales account for

Q42: The amount by which the principal of

Q45: The journal entry to establish the petty

Q55: The entry to record the dishonor of

Q83: Beginning inventory plus the cost of goods

Q105: At December 31, 2011, Bosan Corporation has

Q138: The consistent application of an inventory costing

Q159: If a company sells its accounts receivables

Q199: Bad Debts Expense is reported on the