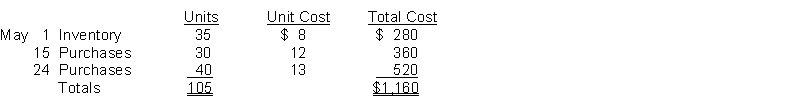

Ford Co. uses a periodic inventory system. Its records show the following for the month of May, in which 75 units were sold.  Instructions

Instructions

Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Prove the amount allocated to cost of goods sold under each method.

Definitions:

Compensation Consultants

Specialists who advise organizations on compensating employees, including wage levels, bonus plans, benefits, and salary structures.

Compensation Systems

Frameworks within an organization that establish how employees are paid, including salary structures, benefits, and incentive plans.

Organizations

Entities or groups of people with a collective goal, structured and managed to meet a need or pursue shared goals.

All-Expenses-Paid Trip

A fully compensated journey where all costs associated with travel, accommodation, and sometimes meals and activities are covered by the sponsoring entity.

Q10: Quintana Company established a petty cash fund

Q30: The balance of a control account in

Q41: Overstating ending inventory will overstate all of

Q48: If an owner withdraws cash for personal

Q87: Income from operations is determined by subtracting

Q95: The sales revenue section of a multiple-step

Q99: The Sales Returns and Allowances account and

Q101: Requiring employees to take vacations is a

Q134: Instructions:<br>State the missing items identified by ?.<br>1.

Q208: Blue Company is unable to reconcile