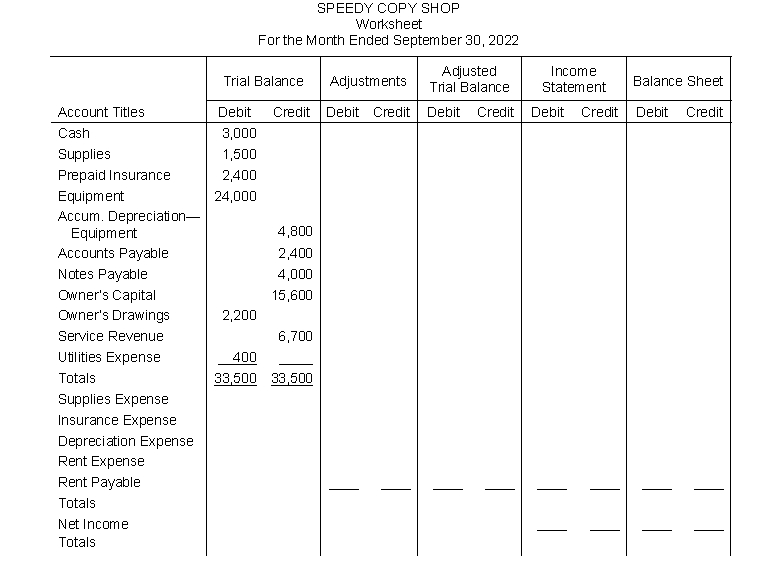

The account balances appearing on the trial balance (below) were taken from the general ledger of Speedy Copy Shop at September 30.

Additional information for the month of September which has not yet been recorded in the accounts is as follows:

(a) A physical count of supplies indicates $500 on hand at September 30.

(b) The amount of insurance that expired in the month of September was $400.

(c) Depreciation on equipment for September was $600.

(d) Rent owed on the copy shop for the month of September was $750 but will not Instructions

Using the above information, complete the worksheet on the following page for Speedy Copy Shop for the month of September.

Definitions:

Permanent Differences

Differences between taxable income and accounting income that originate in one period and do not reverse over time, affecting the effective tax rate.

Temporary Differences

Temporary differences are differences between the carrying amount of an asset or liability in the balance sheet and its tax base, leading to deferred tax assets or liabilities.

Taxable Income

Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year.

Pretax Financial Income

Income of a company calculated before taxes are deducted, often compared to taxable income for tax planning.

Q20: During 2020, Wu Han Co. generated revenues

Q36: The collection of a $6,000 account within

Q50: Which of the following would not be

Q79: Instructions:<br>Using the above information, prepare the closing

Q92: With terms of 2/10, n/30, the purchaser

Q101: What is the proper adjusting entry at

Q119: Cost of goods sold is deducted from

Q121: Monthly and quarterly time periods are called<br>A)

Q134: A debit to an account indicates an

Q144: In order to close the owner's drawings