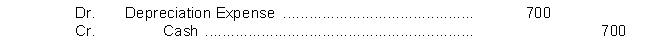

A new accountant working for Brady Company records $700 Depreciation Expense on store equipment as follows:  The effect of this entry is to

The effect of this entry is to

Definitions:

Manufacturing Overhead

All the indirect costs associated with the production process, excluding direct materials and direct labor.

Cost of Goods Sold

Costs directly tied to the creation of products sold by a business, covering materials, labor, and factory overhead.

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time, providing insight into its financial position.

Spreadsheet

A digital worksheet or a software application that allows for the organization, analysis, and storage of data in tabular form.

Q10: _ is sales less sales discounts and

Q20: During 2020, Wu Han Co. generated revenues

Q39: These accounts are among the accounts

Q44: Journalize the following business transactions in general

Q70: Gross profit represents the merchandising profit of

Q105: The credit terms offered to a customer

Q106: Armando Martinez believes revenues from credit sales

Q121: The chart of accounts used by Notwist

Q125: The terms 1/10, n/30 state that a

Q177: The left side of an account is<br>A)