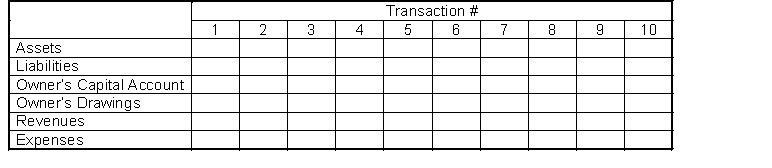

For each transaction given, enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the effect of journal entries on the assets, liabilities, and owner's equity accounts. In some cases there may Transactions:

1. Owner invests cash in the business.

2. Pays insurance in advance for six months.

3. Pays secretary's salary.

4. Purchases office supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash due from customers.

9. Provides services on account.

10. Owner withdraws assets from the business.

Definitions:

Technical Insolvency

A financial situation where an entity's liabilities exceed its assets but it continues to operate because it can meet its short-term obligations.

Accounting Insolvency

A situation where a company's total liabilities exceed its total assets, indicating difficulties in meeting financial obligations.

M&M Proposition I

Modigliani and Miller Proposition I states that under certain market conditions (no taxes, no bankruptcy costs), the value of a firm is not affected by how it is financed, whether by debt or equity.

Static Theory

Static Theory refers to economic theories or models that do not account for changes in the economy over time, analyzing a fixed point instead.

Q11: Credit always means<br>A) increase.<br>B) decrease.<br>C) left side<br>D)

Q51: Rhodes National purchased equipment on October 1,

Q64: Financial accounting provides economic and financial information

Q126: The account titles used in journalizing transactions

Q143: For the items listed below, fill in

Q156: Adjusting entries are often made because some

Q160: Truffles Company paid $860 on account

Q171: For each of the following accounts indicate

Q175: Prepare the necessary adjusting entry for each

Q183: A service performed on account increases both