The following information relates to Questions

Serena Soto is a risk management specialist with Liability Protection advisors. trey hudgens, CFo of Kiest Manufacturing, enlists Soto's help with three projects. The first project is to defease some of Kiest's existing fixed-rate bonds that are maturing in each of the next three years. The bonds have no call or put provisions and pay interest annually. exhibit 1 presents the payment schedule for the bonds.

EXHIBIT 1 Kiest Manufacturing Bond Payment Schedule as of 1 October 2017

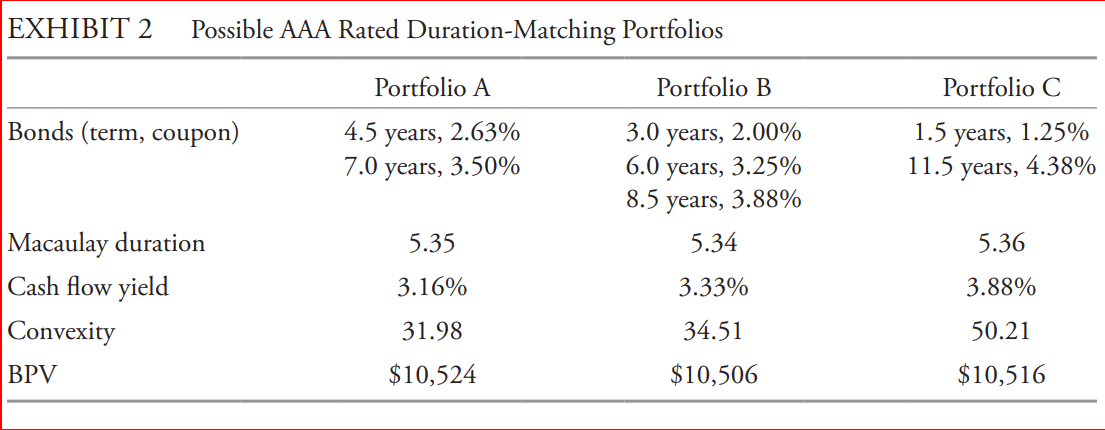

The second project for Soto is to help hudgens immunize a $20 million portfolio of liabilities. The liabilities range from 3.00 years to 8.50 years with a Macaulay duration of 5.34 years, cash flow yield of 3.25%, portfolio convexity of 33.05, and basis point value (bPv) of $10,505. Soto suggested employing a duration-matching strategy using one of the three aaa rated bond portfolios presented in exhibit 2.

Soto explains to hudgens that the underlying duration-matching strategy is based on the

Soto explains to hudgens that the underlying duration-matching strategy is based on the

following three assumptions.

1. yield curve shifts in the future will be parallel.

2. bond types and quality will closely match those of the liabilities.

3. The portfolio will be rebalanced by buying or selling bonds rather than using derivatives.

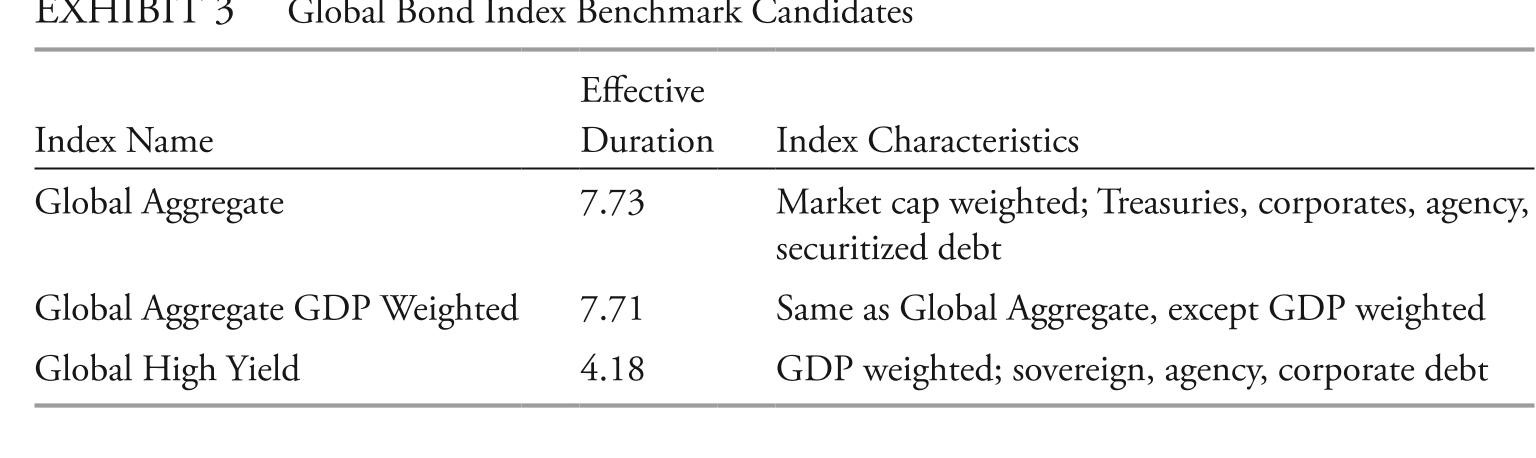

The third project for Soto is to make a significant direct investment in broadly diversified global bonds for Kiest's pension plan. Kiest has a young workforce, and thus, the plan has a long-term investment horizon. hudgens needs Soto's help to select a benchmark index that is appropriate for Kiest's young workforce and avoids the "bums" problem. Soto discusses three benchmark candidates, presented in exhibit 3.

With the benchmark selected, hudgens provides guidelines to Soto directing her to (1)

With the benchmark selected, hudgens provides guidelines to Soto directing her to (1)

use the most cost-effective method to track the benchmark and (2) provide low tracking error.after providing hudgens with advice on direct investment, Soto offered him additional information on alternative indirect investment strategies using (1) bond mutual funds, (2)

exchange-traded funds (etFs) , and (3) total return swaps. hudgens expresses interest in using bond mutual funds rather than the other strategies for the following reasons.

reason 1 total return swaps have much higher transaction costs and initial cash outlay than bond mutual funds.reason 2 Unlike bond mutual funds, bond etFs can trade at discounts to their underlying indexes, and those discounts can persist.reason 3 bond mutual funds can be traded throughout the day at the net asset value of the underlying bonds.

-based on exhibit 2, relative to Portfolio C, Portfolio b:

Definitions:

Support Department Cost

Support department cost refers to the expenses associated with departments that provide essential services or support to production departments but do not directly engage in the production process.

Investment Turnover

A measure of a company's efficiency in using its assets to generate sales or revenue; the ratio of net sales to average invested assets.

Minimum Return on Investment

The lowest acceptable rate of return on an investment, below which an investment is deemed unattractive.

Return on Investment

A financial ratio used to evaluate the efficiency or profitability of an investment, calculated by dividing net profit by the cost of the investment.

Q1: In the context of mortgage-backed securities, a

Q8: Find the slope of the line

Q9: based on exhibits 3 and 4, the

Q12: Eliminate the parameter and write the

Q12: <span class="ql-formula" data-value="\text { Find the limit

Q14: based on Kowalski's assumptions and exhibits 2

Q40: based on Exhibit 2, the implied credit

Q42: Find the expression as the sine

Q44: describe the relationship between forward rates and

Q145: Use the graph of <span