The following information relates to Questions

Serena Soto is a risk management specialist with Liability Protection advisors. trey hudgens, CFo of Kiest Manufacturing, enlists Soto's help with three projects. The first project is to defease some of Kiest's existing fixed-rate bonds that are maturing in each of the next three years. The bonds have no call or put provisions and pay interest annually. exhibit 1 presents the payment schedule for the bonds.

EXHIBIT 1 Kiest Manufacturing Bond Payment Schedule as of 1 October 2017

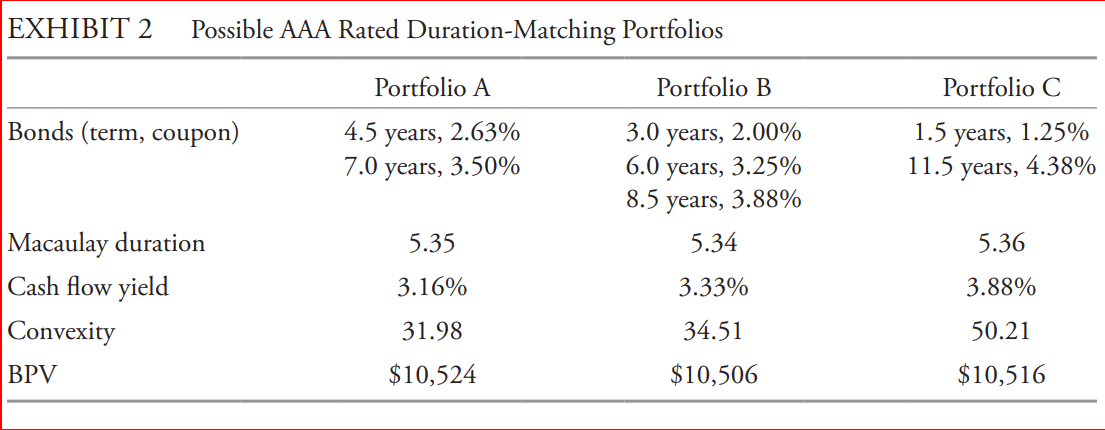

The second project for Soto is to help hudgens immunize a $20 million portfolio of liabilities. The liabilities range from 3.00 years to 8.50 years with a Macaulay duration of 5.34 years, cash flow yield of 3.25%, portfolio convexity of 33.05, and basis point value (bPv) of $10,505. Soto suggested employing a duration-matching strategy using one of the three aaa rated bond portfolios presented in exhibit 2.

Soto explains to hudgens that the underlying duration-matching strategy is based on the

Soto explains to hudgens that the underlying duration-matching strategy is based on the

following three assumptions.

1. yield curve shifts in the future will be parallel.

2. bond types and quality will closely match those of the liabilities.

3. The portfolio will be rebalanced by buying or selling bonds rather than using derivatives.

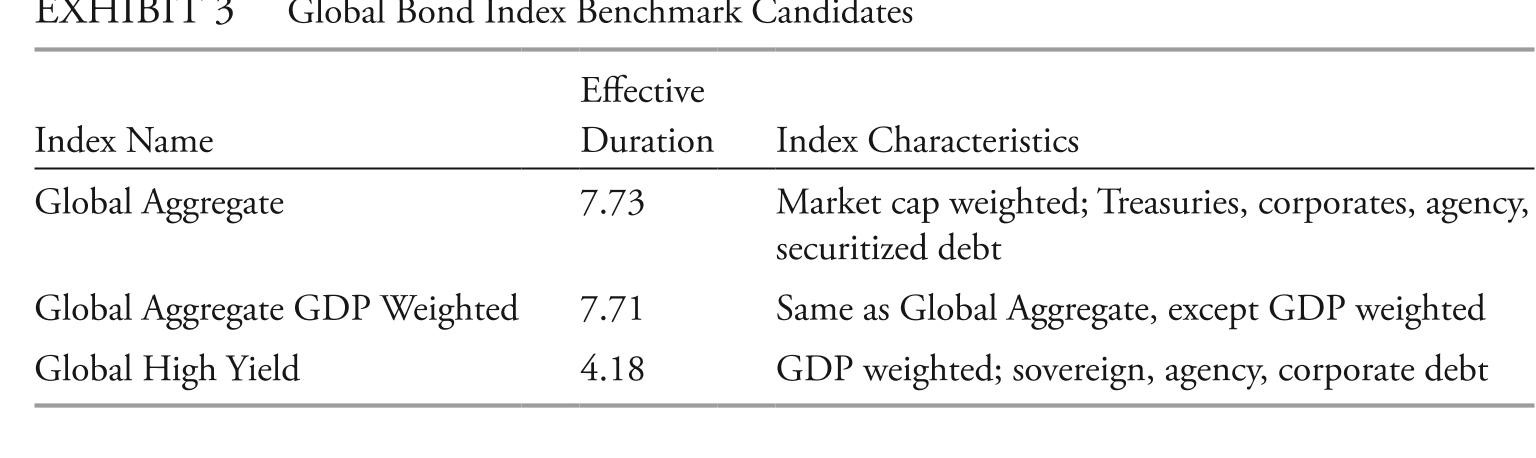

The third project for Soto is to make a significant direct investment in broadly diversified global bonds for Kiest's pension plan. Kiest has a young workforce, and thus, the plan has a long-term investment horizon. hudgens needs Soto's help to select a benchmark index that is appropriate for Kiest's young workforce and avoids the "bums" problem. Soto discusses three benchmark candidates, presented in exhibit 3.

With the benchmark selected, hudgens provides guidelines to Soto directing her to (1)

With the benchmark selected, hudgens provides guidelines to Soto directing her to (1)

use the most cost-effective method to track the benchmark and (2) provide low tracking error.after providing hudgens with advice on direct investment, Soto offered him additional information on alternative indirect investment strategies using (1) bond mutual funds, (2)

exchange-traded funds (etFs) , and (3) total return swaps. hudgens expresses interest in using bond mutual funds rather than the other strategies for the following reasons.

reason 1 total return swaps have much higher transaction costs and initial cash outlay than bond mutual funds.reason 2 Unlike bond mutual funds, bond etFs can trade at discounts to their underlying indexes, and those discounts can persist.reason 3 bond mutual funds can be traded throughout the day at the net asset value of the underlying bonds.

-to meet both of hudgens's guidelines for the pension's bond fund investment, Soto should recommend:

Definitions:

Artistic Works

Original items or creations, like paintings, music, literature, etc., often protected by copyright law.

Capital Assets

Long-term assets such as property, plant, and equipment that are used or held for investment purposes, the sale of which results in capital gains or losses.

Gift

Something voluntarily transferred by one person to another without compensation.

Short-term Capital Loss

A loss realized from the sale or exchange of a capital asset held for one year or less.

Q1: steel wire hangs from a high-altitude

Q4: Forces and couples are applied to

Q5: Determine the principal that must be

Q11: Find the domain of the function.

Q16: Find an algebraic expression that is

Q17: A. list the three factors that have

Q23: Which of the following best describes the

Q32: Find the angle <span class="ql-formula"

Q69: Find the vertex, focus, and directrix

Q102: Use long division to divide.