The following information relates to Questions

SD&r Capital (SD&r) , a global asset management company, specializes in fixed-income investments. Molly Compton, chief investment officer, is eeting with a prospective client,Leah Mowery of DePuy Financial Company (DFC) .Mowery informs Compton that DFC's previous fixed income manager focused on theinterest rate sensitivities of assets and liabilities when making asset allocation decisions. Comp-ton explains that, in contrast, SD&r's investment process first analyzes the size and timingof client liabilities, then builds an asset portfolio based on the interest rate sensitivity of thoseliabilities.

Compton notes that SD&r generally uses actively managed portfolios designed to earna return in excess of the benchmark portfolio. For clients interested in passive exposure tofixed-income instruments, SD&r offers two additional approaches.approach 1 Seeks to fully replicate the bloomberg barclays US aggregate bond index.

approach 2 Follows a stratified sampling or cell approach to indexing for a subset of the

bonds included in the bloomberg barclays US aggregate bond index. approach2 may also be customized to reflect client preferences.to illustrate SD&r's immunization approach for controlling portfolio interest rate risk,Compton discusses a hypothetical portfolio composed of two non-callable, investment-gradebonds. The portfolio has a weighted average yield-to-maturity of 9.55%, a weighted average coupon rate of 10.25%, and a cash flow yield of 9.85%.Mowery informs Compton that DFC has a single $500 million liability due in nine years,and she wants SD&r to construct a bond portfolio that earns a rate of return sufficient to payoff the obligation. Mowery expresses concern about the risks associated with an immunization strategy for this obligation. in response, Compton makes the following statements about lia-bility-driven investing:

Statement 1 although the amount and date of SD&r's liability is known with certainty,measurement errors associated with key parameters relative to interest rate changes may adversely affect the bond portfolios.

Statement 2 a cash flow matching strategy will mitigate the risk from non-parallel shifts in the yield curve.Compton provides the four US dollar-denominated bond portfolios in exhibit 1 for consid-eration. Compton explains that the portfolios consist of non-callable, investment-grade corporate and government bonds of various maturities because zero-coupon bonds are unavailable.

The discussion turns to benchmark selection. DFC's previous fixed-income manager used a custom benchmark with the following characteristics:

Characteristic 1 The benchmark portfolio invests only in investment-grade bonds of US corporations with a minimum issuance size of $250 million.Characteristic 2 valuation occurs on a weekly basis, because many of the bonds in the index are valued weekly.

Characteristic 3 historical prices and portfolio turnover are available for review. Compton explains that, in order to evaluate the asset allocation process, fixed-income port-folios should have an appropriate benchmark. Mowery asks for benchmark advice regarding DFC's portfolio of short-term and intermediate-term bonds, all denominated in US dollars.

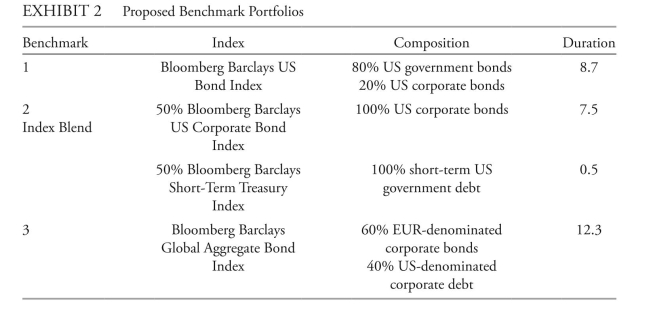

Compton presents three possible benchmarks in exhibit 2.

-relative to approach 2 of gaining passive exposure, an advantage of approach 1 is that it:

Definitions:

Disclosure

The act of making previously unknown information known to others.

Hairstyles

The manner in which a person's hair is cut, styled, and managed.

Disclosure

The act of making new or secretive information known.

Cliques

Small, exclusive groups of individuals who share common interests, often forming within larger social contexts like schools or workplaces.

Q2: <span class="ql-formula" data-value="\text { A composite beam

Q5: Determine the principal that must be

Q6: A motor drives a shaft with

Q13: a profitable equity-versus-credit trade involving delta and

Q13: The type of bond issued by a

Q15: Solve the exponential equation algebraically. Approximate

Q21: Write an equation for the function

Q24: If interest rates increase, an investor who

Q53: Find the distance between the point

Q163: Use the table to evaluate the